All About Summitpath Llp

All About Summitpath Llp

Blog Article

The Ultimate Guide To Summitpath Llp

Table of ContentsNot known Factual Statements About Summitpath Llp All about Summitpath LlpSome Ideas on Summitpath Llp You Should KnowSummitpath Llp Things To Know Before You Buy

Most recently, launched the CAS 2.0 Practice Development Training Program. https://www.easel.ly/browserEasel/14593898. The multi-step mentoring program consists of: Pre-coaching placement Interactive team sessions Roundtable discussions Embellished mentoring Action-oriented mini intends Companies wanting to broaden right into advisory services can additionally transform to Thomson Reuters Technique Forward. This market-proven method offers web content, tools, and support for companies curious about advisory servicesWhile the changes have unlocked a number of growth chances, they have actually likewise resulted in challenges and issues that today's firms need to have on their radars., companies must have the ability to rapidly and efficiently perform tax research and boost tax reporting efficiencies.

Furthermore, the new disclosures might bring about a rise in non-GAAP procedures, traditionally a matter that is highly scrutinized by the SEC." Accounting professionals have a great deal on their plate from regulative adjustments, to reimagined business models, to a rise in client expectations. Maintaining speed with it all can be challenging, but it does not need to be.

Getting The Summitpath Llp To Work

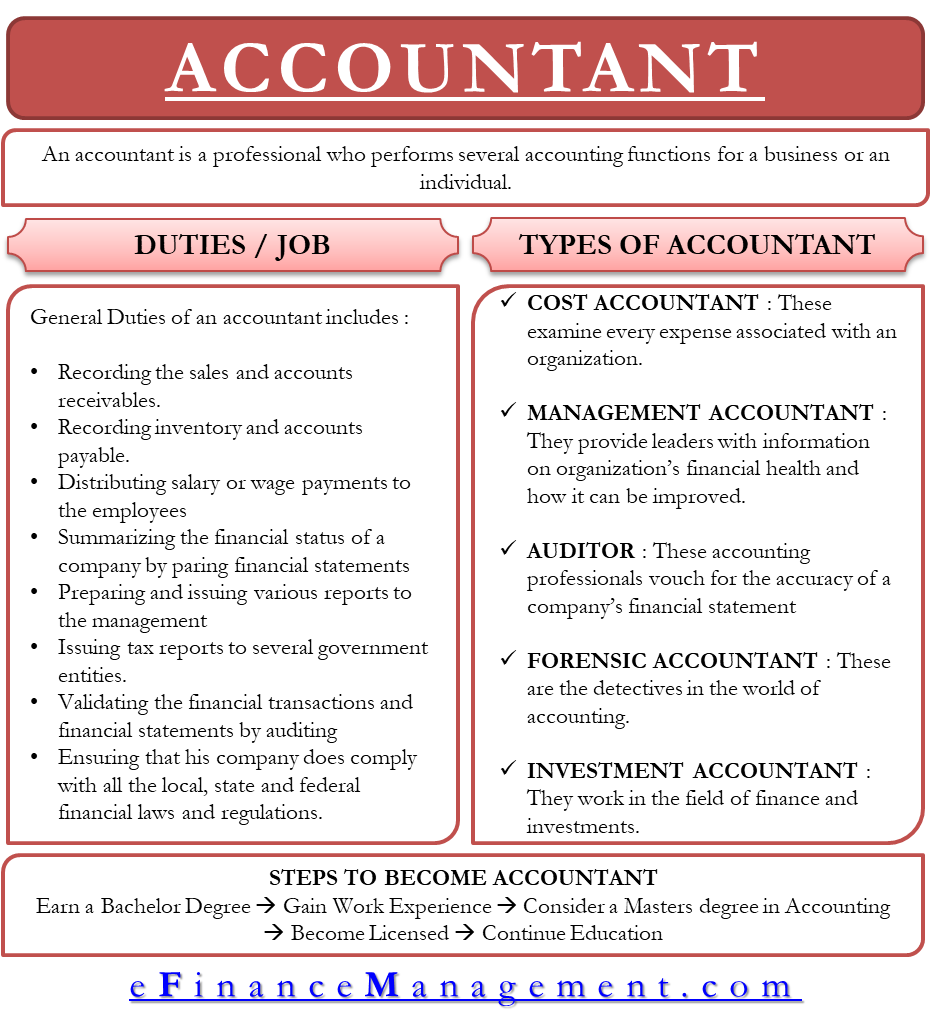

Listed below, we explain 4 CPA specialties: taxation, monitoring audit, monetary reporting, and forensic accounting. Certified public accountants focusing on taxes help their clients prepare and file income tax return, decrease their tax burden, and stay clear of making mistakes that could result in costly fines. All Certified public accountants need some knowledge of tax regulation, however focusing on taxation suggests this will certainly be the focus of your job.

Forensic accountants usually begin as general accounting professionals and relocate into forensic accounting duties with time. They need solid analytical, investigatory, company, and technological audit abilities. Certified public accountants who concentrate on forensic accountancy can often move up into monitoring audit. Certified public accountants need a minimum of a bachelor's level in bookkeeping or a similar area, and they must finish 150 credit hours, consisting of accountancy and business courses.

No states call for a graduate degree in accounting. Nonetheless, an bookkeeping master's level can help pupils satisfy the certified public accountant education demand of 150 credit histories because most bachelor's programs just require 120 debts. Bookkeeping coursework covers subjects like finance - https://trello.com/w/summitp4th/, auditing, and taxation. As of October 2024, Payscale records that the average yearly income for a CPA is $79,080. bookkeeping service providers.

Accountancy likewise makes functional feeling to me; it's not just academic. The Certified public accountant is an important credential to me, and I still obtain continuing education and learning debts every year to maintain up with our state demands.

Fascination About Summitpath Llp

As a freelance consultant, I still utilize all the standard foundation of bookkeeping that I found out in university, pursuing my certified public accountant, and functioning in public accountancy. Among the important things I truly like concerning audit is that there are several jobs offered. I determined that I intended to start my profession in public accountancy in order to find out a whole lot in a brief period of time and see page be subjected to various kinds of customers and various locations of accountancy.

"There are some offices that do not wish to think about somebody for an accountancy duty that is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a very important credential, and I wished to place myself well in the market for various tasks - bookkeeping service providers. I made a decision in college as a bookkeeping major that I intended to attempt to get my certified public accountant as quickly as I could

I have actually met plenty of terrific accountants who do not have a CERTIFIED PUBLIC ACCOUNTANT, but in my experience, having the credential really aids to promote your know-how and makes a difference in your settlement and occupation options. There are some offices that don't want to consider a person for an accountancy role that is not a CPA.

How Summitpath Llp can Save You Time, Stress, and Money.

I actually appreciated functioning on various types of tasks with various customers. In 2021, I chose to take the following step in my accounting profession trip, and I am now an independent audit specialist and company consultant.

It proceeds to be a growth location for me. One vital top quality in being an effective certified public accountant is truly caring regarding your customers and their businesses. I love functioning with not-for-profit customers for that very factor I seem like I'm actually adding to their goal by assisting them have great economic info on which to make clever service decisions.

Report this page